Trade Tracking and Exception Management

Failing trades can have a material impact on your balance sheet, from costs to borrow to penalties and interest claims. They also carry a reputational risk. Multiple legacy systems across asset classes, lack of automated workflows, and lack of oversight fail to identify the trades most at risk. That’s where Meritsoft’s Trade Tracking and Exception Manager (TTEM) comes in.

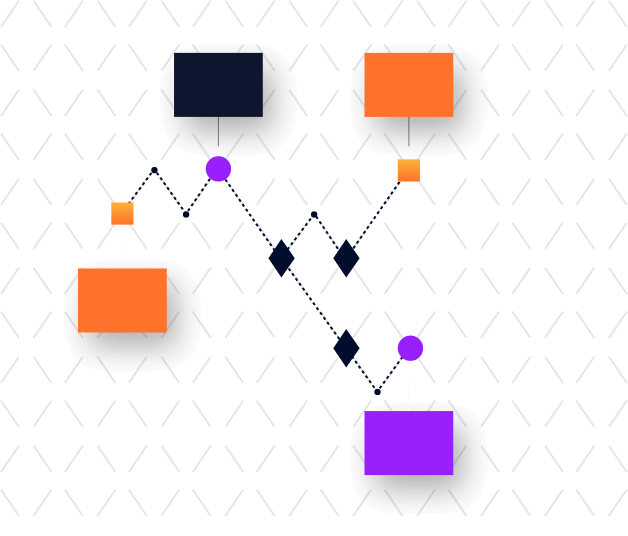

TTEM, our powerful ‘single pane of glass’ automation solution, classifies the risk on each trade and allocates them to your teams allowing you to prioritize the correct trades for maximum matching before market cut offs.

Transform your fails management operations with oversight and trend analysis

TTEM provides highly configurable dashboards allowing supervision of key daily risk metrics and ‘one-click’ work drivers using a library of pre-defined charts, graphs, and tiles.

Analytical comparison of past performance highlights focus areas against internal and market benchmarks.

Our cross-asset solution consolidates and monitors all trade types, across disparate systems, through their settlement lifecycle, from execution to settlement and exception resolution. This helps improve overall trade settlement efficiency – a growing requirement as the compressed settlement cycle under T+1 adds further pressure to operations teams.

Business logic and business processes are defined in workflow rules, and our highly automated, exception-based workflow provides configurable risk-based weightings to exceptions as they are automatically routed to the correct operations team for client servicing. The real-time RAG dashboards are personalized to meet the needs of management, operations, and clients who can also self-serve through the client portal.

Streamlining trade settlement processes and enhancing operational efficiency, our solution is designed to meet the evolving needs of our clients as they look to meet their business objectives within an increasingly time-sensitive trading environment.

A single platform for the trade lifecycle

A holistic view of your trading activity from the point of execution to settlement and beyond. Gather deep analytical insights and KPI reporting to enable continual settlement efficiency improvements.

Should a trade fail, it can seamlessly flow into our CSDR penalty processing and interest claims management systems, automatically assigning fault and giving you a complete transparency of your overall costs of fail.